As a Chief Marketing Officer, you know the value of exclusive deal sourcing that provides a competitive edge. You also know the frustrations of siloed deal flow management that leaves too many opportunities on the table. But there’s a solution that may be just what you’re looking for – innovative ecosystems. These ecosystems provide a way to continuously batch and package deals, providing new hedge fund alternate risk profiles and exclusive family office offerings. Let’s take a closer look at how these ecosystems work and the benefits they can provide.

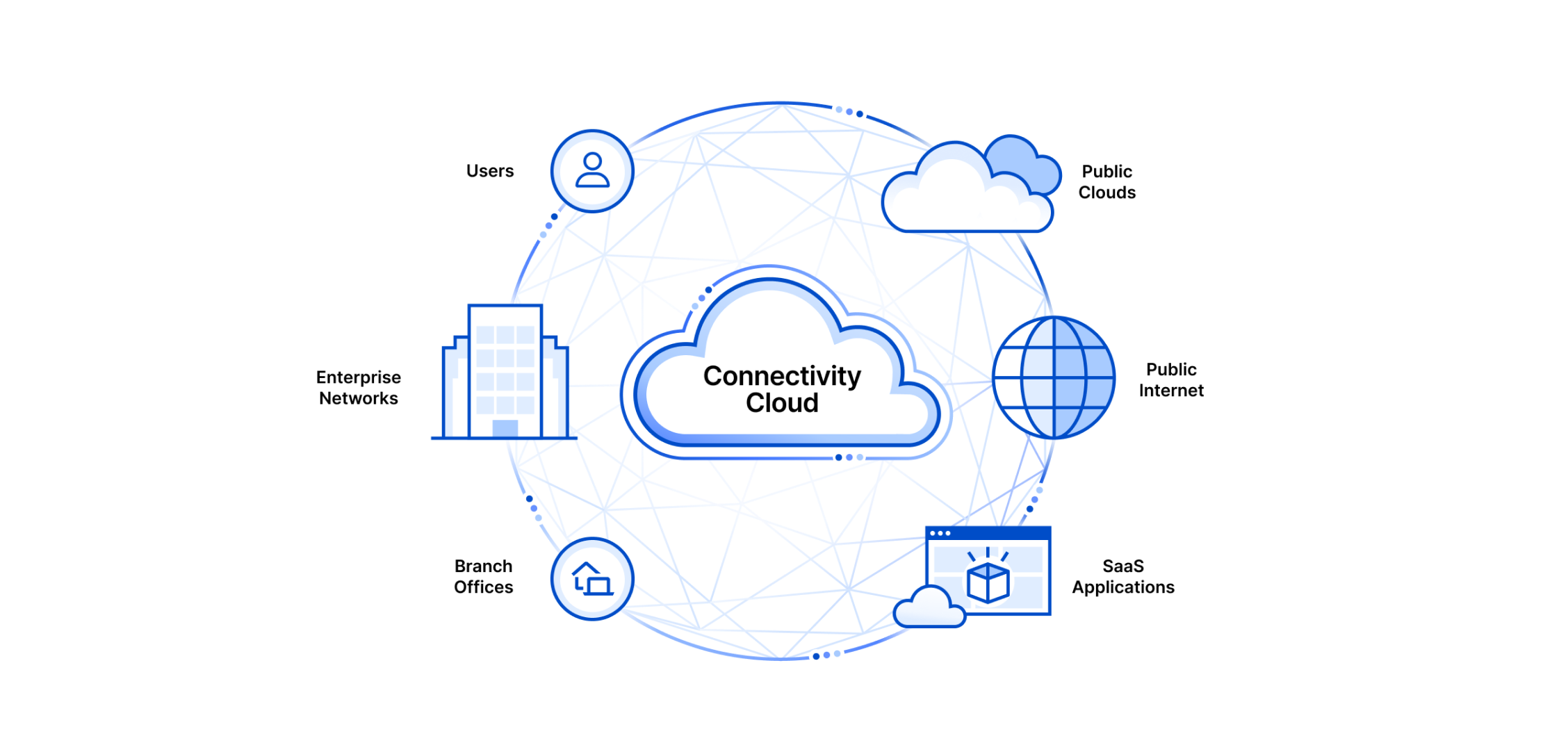

Innovative ecosystems are deal flow management platforms that provide a comprehensive suite of tools and services to meet the needs of alternative investment firms. These platforms offer a central hub for deal sourcing, due diligence, and risk management. They bring together all the players in the ecosystem – including investors, fund managers, service providers, and deal makers – to streamline the deal-making process.

Innovative ecosystems use sophisticated technology to aggregate and process deal flow from multiple sources. These sources include private equity firms, investment banks, venture capitalists, and other deal makers. The platforms then apply rigorous due diligence standards to evaluate each deal. They also provide risk management tools that enable fund managers to monitor and adjust their portfolios in real-time. This creates what is called continuous deal flow batching and packaging, which gives alternative investment firms a competitive edge by giving them access to exclusive opportunities.

Innovative ecosystems offer a host of benefits to alternative investment firms. First and foremost, they provide access to exclusive deals that may not be available through traditional channels. This helps firms to stand out from the competition and provide their investors with unique investment opportunities. Innovative ecosystems also enable firms to stay on top of changing market conditions and adjust their portfolios in real-time. This helps them to manage risk and increase returns. Finally, innovative ecosystems create a community of like-minded investors, fund managers, and service providers. This fosters collaboration, information sharing, and best practices, which helps to further differentiate firms from their competitors.

Innovative ecosystems are a powerful tool for alternative investment firms looking to boost their deal flow and stay ahead of the competition. They provide a central hub for deal making, due diligence, and risk management, enabling firms to continuously batch and package deals. This creates exclusive family office offerings and new hedge fund alternate risk profiles. If you’re a Chief Marketing Officer looking for a way to provide your firm with a competitive edge, consider exploring innovative ecosystems. The benefits they provide may be just what you need to take your firm to the next level.

Connect with MediaTech today at: https://mediatech.ventures

Or Apply For A Complimentary Consultation Here: https://www.rocketnow.com/new-event-application/